Plan Vigilancia Ambiental

2025

Conoce nuestros Servicios

Promoviendo la economía azul

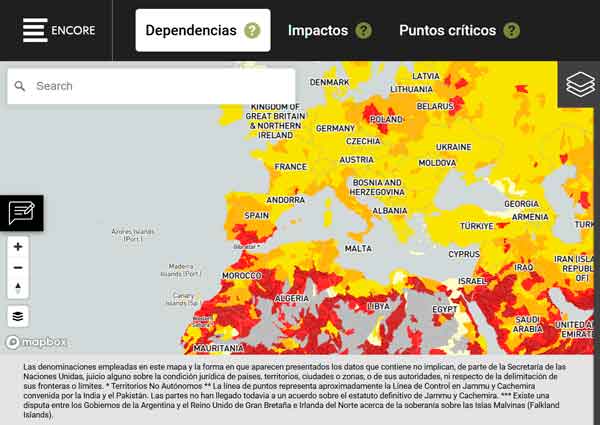

En Tecnoambiente, somos protagonistas de la economía azul, ofreciendo soluciones avanzadas en geociencias marinas y gestión sostenible de recursos oceánicos. Nuestra experiencia en adquisición y análisis de datos marinos permite a nuestros clientes desarrollar proyectos responsables que impulsan las energías renovables offshore, la electrificación y conectividad submarina, sin comprometer la salud y biodiversidad del ecosistema marino.

Acelerando la transición verde

Como aliados estratégicos en la transición verde, apoyamos a empresas e instituciones a adoptar estrategias y prácticas sostenibles. Mediante consultoría especializada, ensayos de laboratorio y control ambiental, contribuimos a reducir la huella ecológica, impulsar la transición energética, luchar contra el cambio climático y avanzar hacia una economía circular, acelerando el camino hacia un futuro más sostenible y resiliente.

Una historia de más de 40 años y de 3.000 proyectos transformadores en Europa, África y Latinoamérica

Plan Vigilancia Ambiental

2025

Fos Archaeological Survey Project

2025

Roadmap en capital natural

2025

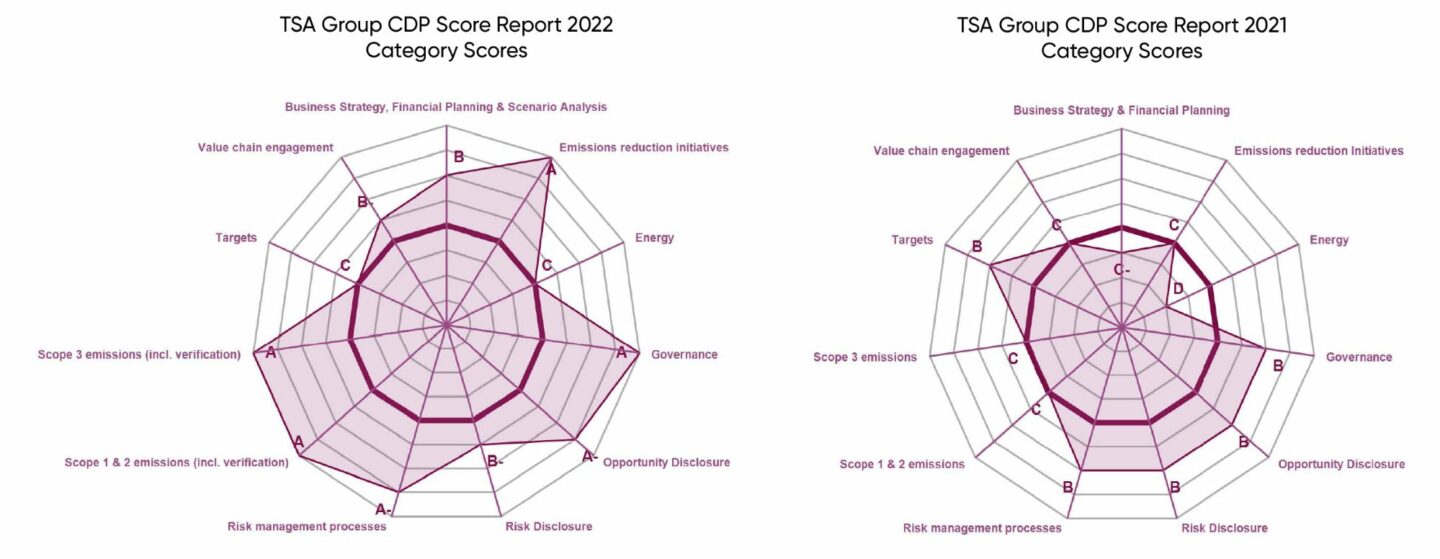

Asistencia para Reportes CDP: Clima, Agua y Bosques

2025

LIFE InBioSoil, an initiative turning fungi and bacteria into tools for soil restoration in Europe

25/11/2025

Tecnoambiente estrena web renovada, reflejando su crecimiento y fortaleciendo su presencia digital

18/11/2025

PortsIB invierte más de 100.000 euros en restaurar la posidonia del puerto de Fornells

22/10/2025

La investigación geofísica desbloquea el proyecto de energía de olas de 10 MW en Portugal

18/09/2025